Latest Blog Posts

The Market is Going Down. How Does This Affect You?

The last week or so has seen the Australian share market drop to a 6 month low, with the ASX200 finishing at 5,837.1 points on Monday.

Your Greatest Asset is Your Ability to Generate an Income

This week we're continuing our education theme on insurance, and we'll branch into one of the more common types of insurance, that of income protection.

TPD Insurance is a Safety Net For When the Unthinkable Happens

How long could your family survive financially if you were suddenly unable to work? This week we'll continue our discussion on insurances, but focus on Total and Permanent Disability or TPD insurance.

The Reality of Insurance; It's There When You Can't Be

How long could you last financially if you lost your job, or worse, couldn't work at all?

The Cost of Doom & Gloom

We've certainly been hearing a lot of doom and gloom in the news lately. If it's not something to do with our politicians, it's a focus on the housing crisis or the teetering global economy.

Protecting Your Business Now, & in the Future

This week's article is directed towards small business owners, and specifically around protection for the business asset.

How to Effectively Manage Cashflow

We often bandy around the phrase "cashflow" but it's probably time we took a deeper dive into this concept. "Cashflow" refers to the amount of money coming into your accounts or your business, as well as the amount that's going out.

Are You Ready to Grow Your Wealth? Then it's Time to do This!

We've recently spent some time discussing the importance of defining your relationship with money and then getting clear on how to make a start with an investment plan.

How to Use Your Tax Return to Kickstart an Investment Portfolio

It may come as a surprise to learn that the biggest regret most people have with their investing is not where they've placed their money.

How Your Values Influence Your Wealth

We spend a lot of time discussing what the best strategies and tips are for growing your wealth position, but one thing we need to get clear on is why you're building or preserving wealth in the first place?

Why You Must Always Pay Yourself

This week's topic – the importance of paying yourself - can be more complicated than it seems on first glance.

The Latest Legislative Changes for Business

If you're in business or find yourself in a decision making role in someone else's business, then this week's content is for you.

What is The Real Value of Your Investment Dollar & Returns?

Anyone who has spoken to their parents or grandparents about the cost of living will be familiar with the idea that the relative value of money has changed over time.

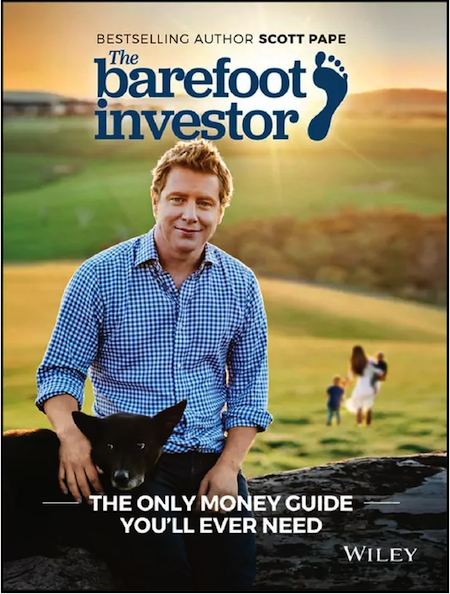

How to Grow a Wealth Mindset

For those who are interested in building your knowledge level around wealth, this week's post is for you! Here at Schuh Group, we encourage you to become as educated as possible in the field of investing and money management.

What's Your Investment Type?

What better way to finish off the financial year than with some consideration about investments?

Investing 101: Making Sense of Investment Terms

When it comes to investing, it can be a minefield for both the amateur investor and the professional alike.

The Royal Commission Exposes Potential Problems with Super Recommended by Banks

Much has been going on in the background with the Banking Royal Commission of late, and we feel it would be timely to comment on how this relates to your superannuation funds.

Choosing the Best Super Fund for You

We talk about Super a lot when it comes to tax planning and wealth creation, but you certainly want to make sure you've got the right vehicle for the job.

Can You Make Super & Tax Work Better Together?

If you've been reading our blogs for a little while now, you may have picked up on the fact that we're big fans of superannuation.

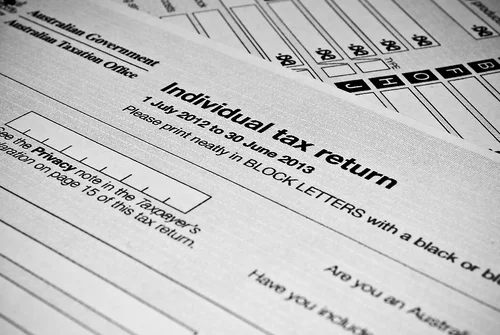

Tips to Minimise Your Tax Ahead of EOFY

Now that the end of financial year is just around the corner, it's time to put some real focus into your tax minimisation strategies.