Latest Blog Posts

Bookkeeping 101 - How to Stay Ahead of the Game

Bookkeeping can be an often-overlooked component of any small business, but it can sometimes be the difference between success and failure. Bookkeeping refers to the keeping of records of the financial affairs of a business, but it is also a legal requirement for businesses to have records that are up to date. In this video, you will learn what you need to know to ensure that you have the best bookkeeping practices in place for success.

2020 Federal Budget Review

The Federal Treasurer, the Hon. Josh Frydenberg MP, delivered the 2020 Federal Budget on 6 October 2020.

As widely anticipated, the announcement included bringing forward personal income tax cuts already legislated. Together, these changes deliver tax relief to low- and middle-income earners for the 2020-21 income year of up to $2,745 for individuals and up to $5,490 for dual income families. The Treasurer also announced a range of taxation benefits for small and medium businesses, intended to stimulate the business sector leading to jobs growth.

This summary provides coverage of the key issues of most interest to you.

A Closer Look at Sustainable Investing

“ESG Investing.” You’ve probably heard the term, but what does it actually mean? ESG stands for Environmental, Social and Governance, it may also be termed “sustainable investing.” It is a wide term as it can cover several areas, but essentially, it’s for investors who still want positive returns, but also consider their long-term impact on society, environment and the behaviour of a business.

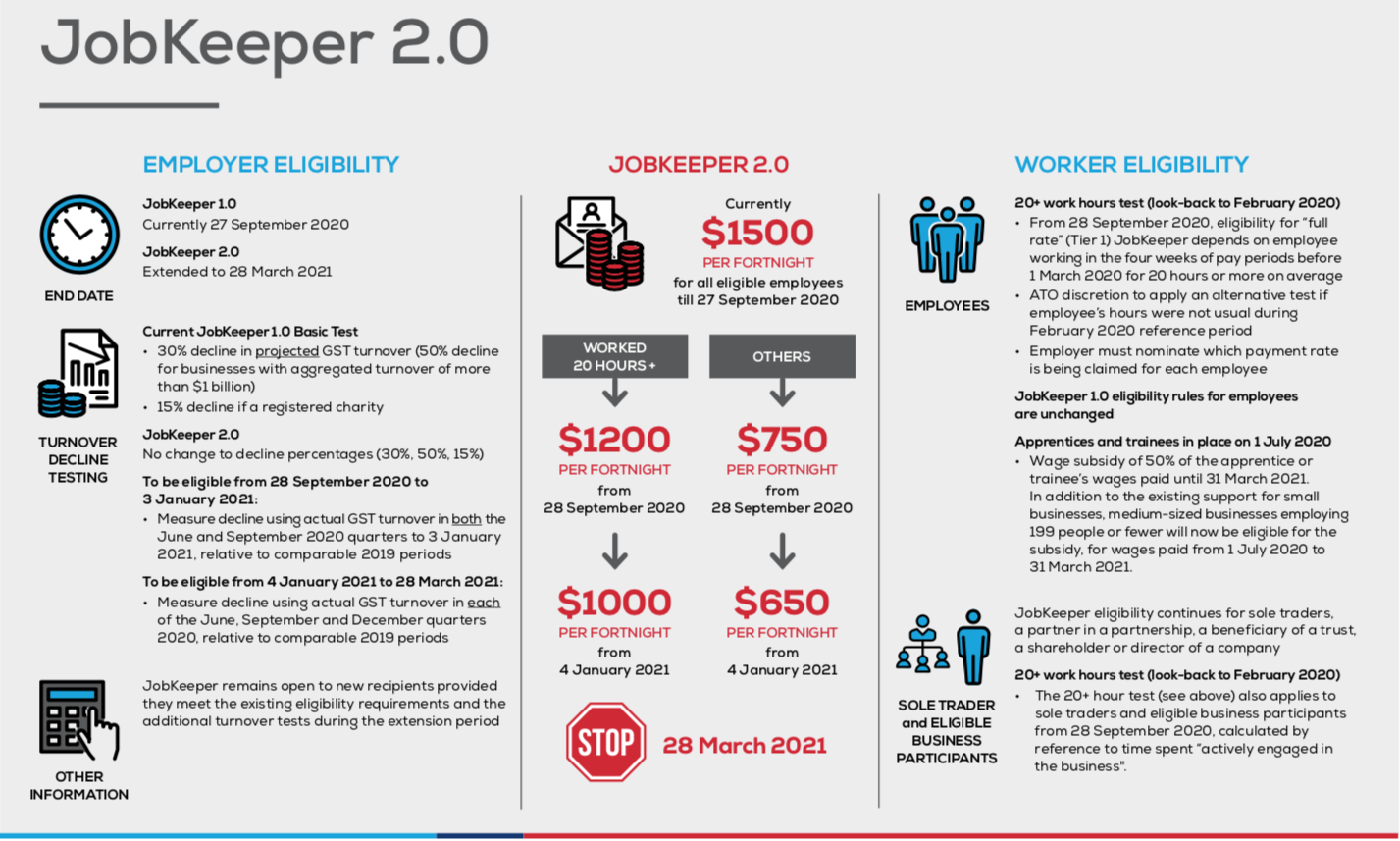

JobKeeper 2.0 - Breaking Down How the Changes Will Affect Your Business

As we move closer to the shakeup of the JobKeeper payments, our team have put together a concise summary of the many parts that business and clients need to consider. Key dates, assessment of eligibility and how your employees will be paid are all considered in this article.

Important changes to jobkeeper

As we near the end of September, important changes will be happening for all business including Sole Traders currently receiving Jobkeeper support. Now is the time to make sure you are on track to meet all new lodgement and re-assessment obligations to ensure you continue to receive support for your business through these trying times.

2021 Superannuation Contributions Cap Update

At the beginning of the new financial year, the ATO announced changes to the way superannuation contributions are managed and governed. Most of these changes are effective from 1 July 2020 so it’s important to get across them and understand how they affect your individual financial situation. This article will take you through the main superannuation contributions rules and changes.

The Ins & Outs of Super - How to Choose What is Best For You

We talk about super a lot when it comes to tax planning and wealth creation, but you certainly want to make sure you’ve got the right vehicle for the job. If you get the selection right, you’ll have many happy years of investment returns ticking away in the background. If, on the other hand, you get it wrong, you’ll literally see thousands of dollars pass you by over the lifetime of your fund.

Tax Tips & Key Dates

As we move through the first quarter of the financial year, the lodgement obligations for this period are many and an important part of finalising the prior financial year to allow Income Tax Returns to commence lodgement. We have provided a detailed list of some of the key lodgement obligations for your business.

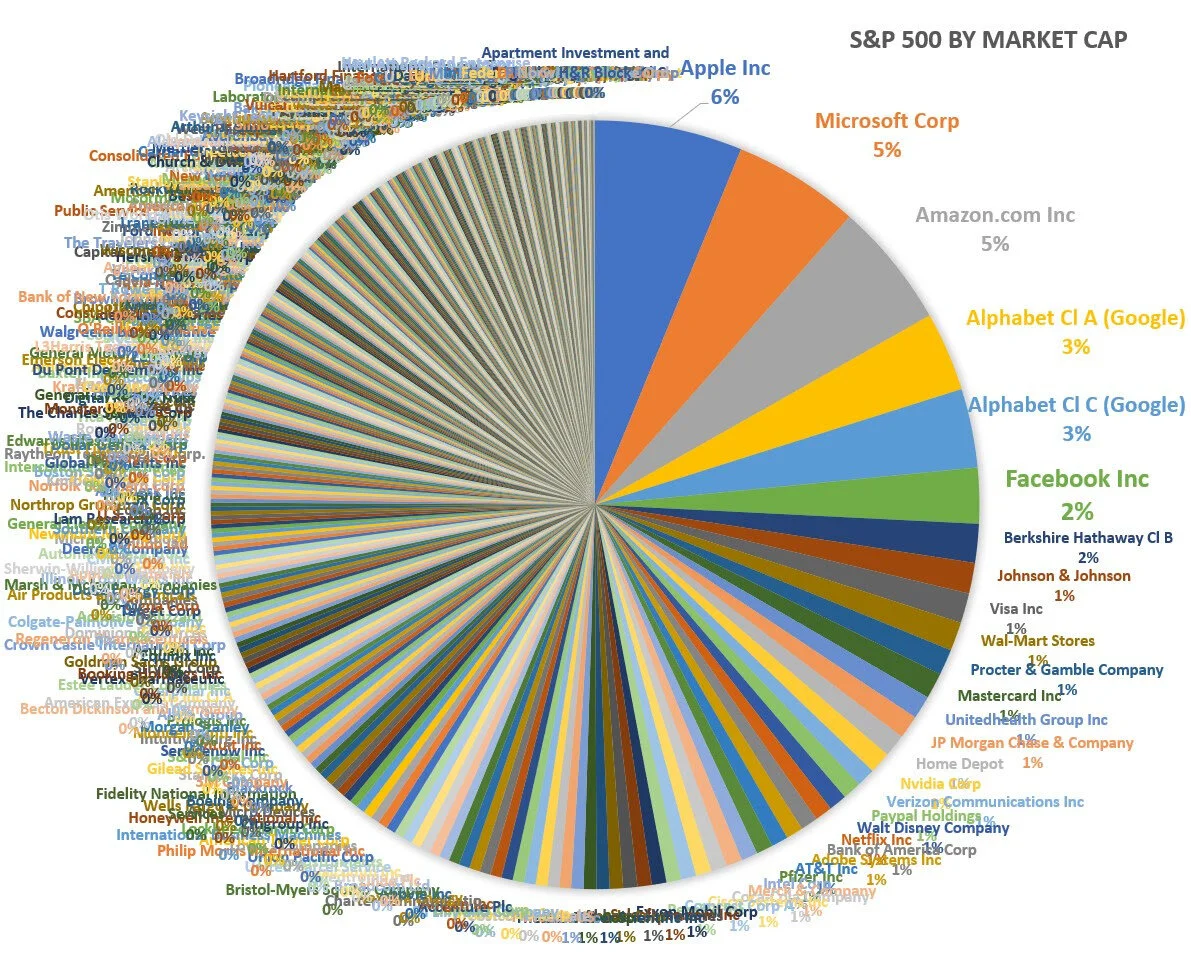

Stocks, Sectors & the Economy

As the virus drags on, economies start to look bleak. Investors who rode the markets down to the depths of March and back out again, start to think… ‘None of this makes sense, surely the market is going down again.’ Wave two condemns Victorians to house arrest, and a seemingly never-ending wave continues to plague the US. So how do some stockmarkets keep moving up? Or at the minimum, keep levitating above where you think common sense dictates they should be?

What is it all For? Why Knowing the Legacy You Want to Leave is Key to Creating True Wealth

As we make our way well into the new financial year, now is a great time to take a moment and reflect on what it is that we are creating and shooting for. For some of us, that may mean a reflection on our plans for retirement. It is important to note, however, that retirement is about more than just having enough money to live on, it’s also about having something to live for.

What Do You Do When the Kids Are Gone? Wealth After Children

Well, they’ve finally left the nest and now you’re trying to get reacquainted with your spouse! The kids leaving home can either give you a great sense of freedom or leave you struggling to find other activities to fill in your time. Either way, it’s the perfect time to review your financial plans and set yourself on course for the next stage of life.

Understand the Best Structures for Your Business

Just like different shoe sizes work for different people, different structures work for different businesses, families, and individuals. Depending on the purpose of your business, its size and other family investments understanding how to structure yourself is not a simple in the box exercise.

JobKeeper 2.0 – What this Means for You

One thing that is certain with these Coronavirus times is the frequency of changes, and last week’s announcements by the Federal Government were no different. As expected, the Government is scaling down how much it pays to employees currently on JobKeeper.

The Latest Update on JobKeeper

This is the latest update for small business owners regarding the JobKeeper payment.

Out With the Old and In With the New

As we say goodbye to the 2020 financial year, our opportunity to reflect on what we have learned or what we can improve on is tainted by an element of uncertainty as we continue to battle the fallout of COVID-19. Many business owners continue to re-open and return to some form of normality while others still grapple with a restricted existence. For many businesses, now is the time to consider what opportunities may be available in the new financial year.

Happy New Financial Year. Creating a Wealth Mindset for the Year Ahead!

Investing and wealth creation is as much about your mindset as your financial position. Money and its management can evoke many emotions in people and in the video below we explore how you can best prepare yourself for success when navigating the share market.

The True Cost of Insurance for Life

Insurance is the warranty for when life hands you the unexpected. Hopefully, you will never need to cash in on it, but having it means you can sleep a little easier at night.

The Pre-Retirement Squeeze

COVID-19 is changing lives, goals and plans. Those coming up on retirement may have the rug pulled from under them in both the short and long term. The various assumptions they made may no longer be reliable as the stability of their circumstances has turned on their head.

Active Managers Not Shining in Crisis

Active managers are once again ready to step into the light and prove their worth in volatile investment markets. It’s a cycle as old as time, you can set your watch by it. A new year rolls around or maybe there’s some market volatility and these articles start coming thick and fast. Active fund managers with good teeth and $100 haircuts are being fawned over by journalists. This is the time we’ll need their expertise.

It's Nearly June 30 - Here is Your EOFY Checklist

As we head towards the 30th June cut-off date, the focus of business owners shifts greatly towards ensuring all lodgements have been made prior to the cut-off date to ensure the optimal income tax position has been achieved. The key word at this time is planning.